Home » GST Registration online

GST Registration Online

Why to Choose WAG CONSULTING GROUP ?

- Hassle-free Online Registration process.

- At comfort of your home, no office visit required.

- Complimentary first month GST returns filing.

- GST compliances are done under the supervision of CA's.

- GST laws are comlex and changes continually.

- For an easy, quick and accurate registration process.

Online Registration at just Rs 999/only

Topics Covered

Who is liable to do GST Registration ?

Registration Steps

Documents required for GST Registration

Frequently Asked Questions

Who is required to get GST Registration ?

-

Turnover basis - Any businesses which have a turnover of above Rs. Forty lakhs (Rs. 10 Lakhs for the North Eastern States, J&K, Himachal Pradesh & Uttarakhand), and Rs 20 lakhs in case of services.

- E-commerce operator - Persons doing e-commerce business is required to get registered under GST irrespective of their turnover value

- Casual Taxpayer - People who supply goods or services in events/exhibitions & don’t have a permanent place of business need to get GST Registration mandatorily. The validity is 90 days from the date of the start of activities

- Inter-State supply of goods or providing services It is necessary to have GST registration for Interstate sales or services providers irrespective of turnover value

- Dealing with online information - The person is supplying online information and database access or retrieval services from a place outside India to India, other than a registered taxable person.

- NRI exporters & Importers - Regardless of Turnover any NRI company or person needs GST registration if they supply goods or services in India

- Already registered under Pre GST law - Entities/persons which were already registered under VAT, excise & Service tax.

- Voluntary Registration - Any business with a turnover of lesser than 20 lakhs can voluntarily register for GST even though it is not compulsory by law.

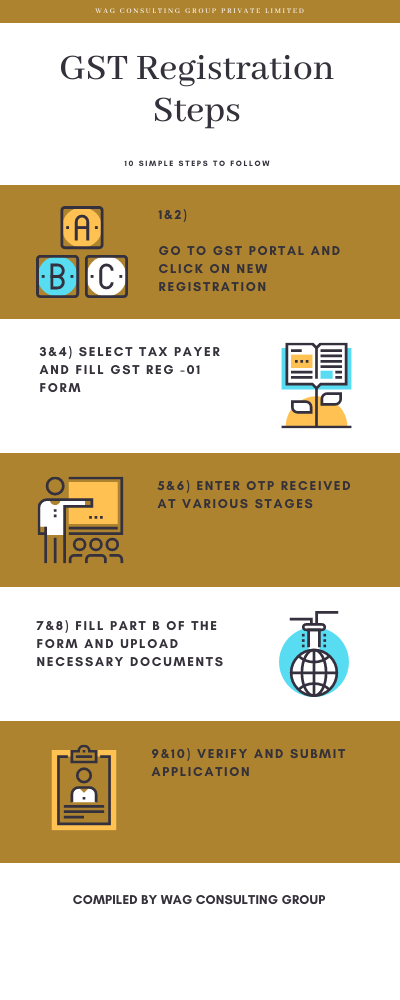

GST Registration Steps

- Step 1:- Go to GST Portal. GST Registration website link is https://www.gst.gov.in/

- Step 2:- Click on Registration under the Services tab and then click “New Registration.

- Step 3:-Select the “ Taxpayer” option from the drop-down menu.

- Step 4:- Now fill GST REG -01 form by filing details like State name, Legal name of your business, PAN no., email id, and Mobile no. Then, click on the “proceed” tab.

- Step 5:- Enter OTP received on email id and Mobile no. & click continue. Temporary Reference Number (TRN) will be generated & sent on your email id and mobile.

- Step 6:- Again, go to the GST portal. Click Register now. Enter TRN, captcha code then click on proceed. Enter OTP received again on Registered email and mobile number - then click proceed.

- Step 7:- Status of the application is shown in drafts; click on the edit icon.

-

Step 8:- Now, Part B of the form will open. Fill the necessary details and upload the documents required mainly:

- Photograph

- Constitution of taxpayer

- Proof of place of business

- Bank accounts details

- Authorization form -

Step 9:- Now go to the verification page, tick on the declaration and submit the application using the following ways:-

- Companies must apply using DSC

- Using e-sign OTP will be sent to Aadhar registered number

- Using EVC –OTP will be sent to the registered mobile. -

Step 10:- After successful completion, Application Reference Number (ARN) will be issued. You can check ARN status by entering ARN in the GST portal

.Registration Certificate:- The GST registration certificate & GSTIN will be issued upon verification of GST application and other mandatory documents by the GST officer.

Download the GST Registration certificate from the GST portal.

Documents Required for GST Registration Online

The list of documents required for registration of GST as per various categories are as follows

-

For Proprietorship:-

- PAN Card

- Address Proof

- Proof of place of business

- Bank accounts details

-

For LLP (Limited Liability Partnership)

- PAN Card of LLP

- LLP Agreement

- Partner's name and Address proof

- Proof of place of Business -

For Private Limited Company

- Certificate of Incorporation

- PAN Card of Company

- Articles of Association (AOA)

- Memorandum of Association (MOA)

- Resolution signed by Board Members/Board of DIrectors.

- Identity and Address Proof of Directors

The following can be shown as proof of address

- Passport

- Voter Identity Card

- Aadhar Card

- Ration Card

- Telephone or Electricity Bill

- Driving Licence

- Bank Account Statement

PENALTIES FOR FAILURE TO GST REGISTRATION

As per Section 122 of the CGST Act, any taxable persons who fail to register for GST even though it is required as per the GST Act, have to pay the following amount as penalty.

Rs.10,000 or amount of tax evaded, whichever is higher.

BENEFITS OF HAVING REGISTRATION

- BECOME MORE COMPETITVE IN MARKET:– Interstate trading is impossible without having a GST number.

- EXPANSION OF BUSINESS ONLINE:- GSTIN must be acquired if we are willing to compete on the eCommerce platform or through your website.

- GET INPUT TAX CREDIT:- If we have GST number, we can avail Input Tax Credit while filing GST returns.

Frequently Asked Questions

There are no Fees for GST registration levied by the GST department.

Yes, you can apply online by following all the steps, as discussed in the above article.

Minimum 3 days provided there is no re-verification. If there is any verification, it will take another seven days.

Go to the GST portal https://www.gst.gov.in/. Enter log in details, then click on Services, then Returns, then Track return status

If you have a yearly turnover of less than Rs 20 lakhs in case of the service provider, Rs 40 lakhs in case of dealing in goods, there is no requirement to have a GST number. You can voluntarily apply if you want. If you are in the northeastern states threshold limit for GST Registration is Rs. 10 lakhs

GST is not applicable on following

• Petroleum crude

• Motor spirit

• High-speed diesel

• Natural Gas

• Aviation Turbine

No, there is no need to be physically present during registration. If we are applying online, we need to have a system, necessary documents only.

Or we can take the help of any consulting firm.

Any businesses with a yearly turnover of above Rs. 40 lakhs (Rs. 10 Lakhs for North Eastern States, J&K, Himachal Pradesh & Uttarakhand), Rs 20 lakhs in case of services have to obtain GST number.

Yes, GST applies to all Manufacturers, Traders, & Service providers

Under GST law, only one registration is allowed against one PAN. But if the business is operated in more than one state, there must be separate GST numbers for each state.

ARN denotes Application Reference Number. ARN is conclusive proof of submission of GST registration.

ARN is generated after a Temporary Reference Number(TRN) when we upload all required documents.

After having a GST number, you have to raise GST invoices to your customers and charge GST in Invoice.

Monthly you have to pay taxes online.

If all the required documents are not submitted, or false documents are submitted during registration, then the GST officer can reject it. You have to apply again after that.